- Introduction

- Preparation for investment

- Individual life cycle

- save first spend later

- reduce commitment then save more

- emergency fund or buffer

- protection loss of income

- buy term invest the rest

- pure protection coverage

- holding period

- lifestyle does matter

- compounding interest

- Rules of 72 – Albert Einstein

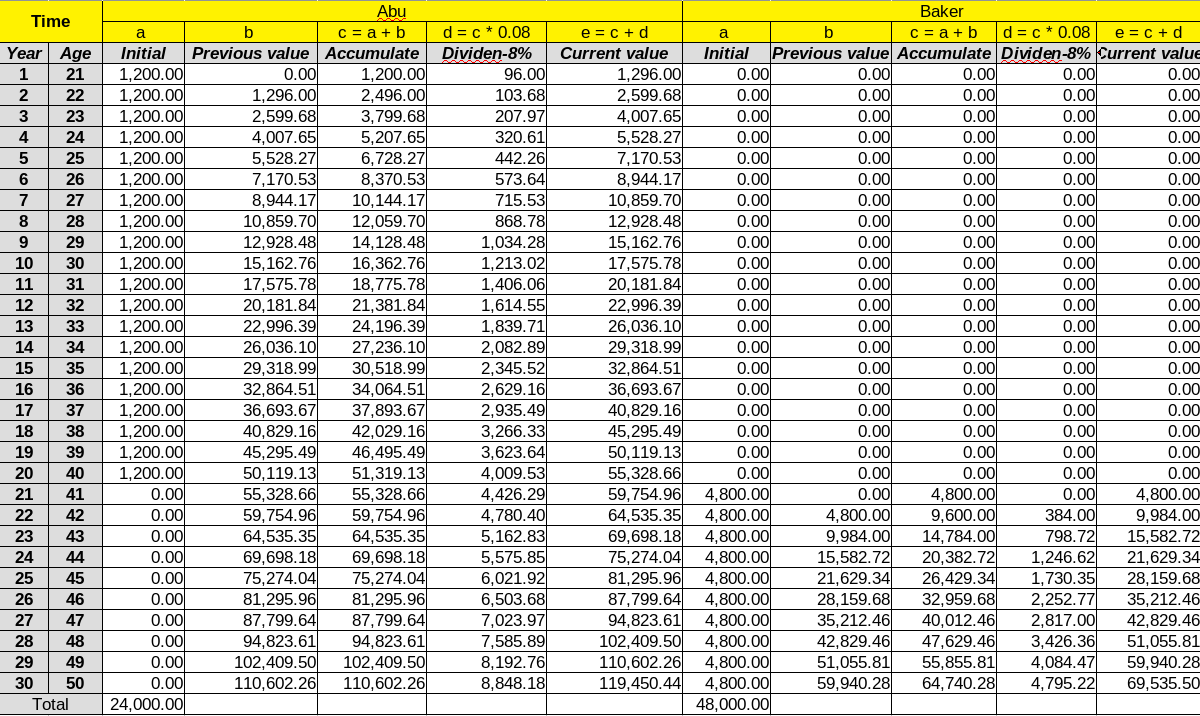

- abu vs baker

- delay or procrastination

- Friend or foe

- Rules of 72 – Albert Einstein

- why you should invest

- money and inflation

- personal objectives

- setting goals for your investment

- Retirement fund

- Education fund

- Traveling fund

- risk appetite

- knowing yourself

- difference between conservative, moderate and aggressive risk

- basic economy lesson

- should i learn or know about economy

- demand and supply

- next best alternative forgone/opportunity cost

- complement product

- Risk management

- Control between Internal & External Risks

- Greed & fear

- reverse the crowd

- opportunity in market volatility/fluctuation

- market factors and liquidity

- knowing your spread cost

- simple logic buy low sell High (why holding power matters)

- Pillars investment strategy

- dollar cost averaging

- asset allocation

- rebalancing

- Do’s and dont’s in investing

- Against the crowd dont follow

- Don’t ever-ever timing the market

- Choose software monitor and updates investment portfolio

- Nature between Investor VS Gambler

- choosing your preferred investment vehicle

- gold, silver, stock market or anything

- hybrid?

Table of contents

Introduction

Welcome to a journey Investment 101.

Investment 101 is a guide to knowing, comprehend, planning, executing, revise and achieving your financial goals. It doesn’t matter what age you are or how much do you earn but it is a matter what, when, how and why you should start your journey towards if not financial freedom at least financial independence.

Most of the context in Investment 101 is applicable to any part of continents you lives in. However if you think it’s differently like those countries in civil war such as Libya, Syria or Ukraine then it most probably not applicable.

Why invest?

There are plenty reasons why do people invest. The most common one is about profit. However how many are making real profit compared to losses. Are investor skills bound to the ability to read the fluctuation price of the market? Knowing that candle sticks etc. Can you guarantee it will always be profitable.

Investment objectives

Do you need to have investment objectives before do your investment. Why dont you just straight away jump into investment and hopefully to make money instantly.

Investing without objectives is like sailing a boat without having a destination. Float and sails but with no direction. Not to mentioned the risks of hit by the storms, pirates or out of food stocks while on the board that lead to starvings.

Did I mentioned about risks just now? Yeah I did. Invesment is mostly about knowing and handling risks. The more or better you can handle risks there is more likely you are going to achieve your investment target and objectives.

Can you be successful in investment?

Investment is doable. It is not a rocket science subject. You dont need to be genius to achieve your life dream and be successful in investment. It doesn’t requires for you to have bachelors of degree to understand what is the principles of investment even though it can be helpful if you do so. You need to have some basic maths and good understanding with English. Just read word by word, line by line from one page to another until the ends. That’s all.

This guide are not meant for you if…

Before that let me assure that this guide is not meant for you to learn those technical pricing movement charts like candle stick and predicts what will lies in the future. If you expect that kind of things then you shall not stay here. Look for other places.

Preparation for investment

I am going to put a list of investment preparation that you should need to take into action. However this is not an exhaustive list guide. In between you are free to do what is the best suits to your current financial condition. My best advise always look for those professionals to seek their opinion on how can your improve and justify on your thought or have learnt about investment or financial planning.

Individual life cycles

Usually different age will contribute to different life cycles. If your age between 22 to 26 years old then by now you just completed your study and started looking for a job or building a stable career. Start to earn and get your personal paycheques. Spend some while save some perhaps. Get into few commitments like study loan, car financing etc.

To explain more about Rise and fall of a person's net worth over his or her lifetime I think that Investment Analysis and Portfolio Management - 5th edition book written by Frank K. Reilly and Keith C. Brown explains better about different ages individual life cycles. The chart simplifies about it.

This chart shows there are three different phase for individual:

- Accumulation phase

- Consolidation phase

- Spending/gifting phase

Note: Refer page 39, Investment Analysis and Portfolio Management

Save first then spend later

Term Save first then spend later might be weird to you. Most peoples get to used with Spend first then save later... Here is the diagram that helps to gives most of real life scenarios including you.

| Description | Ringgit Malaysia (MYR) |

|---|---|

| Income | x,xxx |

| less: Expenses | (x,xxx) |

| Savings/Deficit | x,xxx |

Spend first then saves later | Description | Ringgit Malaysia (MYR) |

|---|---|

| Income | x,xxx |

| less: Saving | (x,xxx) |

| Expenses | x,xxx |

Save first then spend later Based on these two diagrames it is obvious that what will excite the most or motivates you to save more. If you opt for or get used with spend first then save later most probably will spend to the maximum. You might end up with no saving or worst things is having to lend like swiping that plastic cards such credit cards to cope up with your wants instead needs. More if the trends keep going this will lead to deficit on your financial status and heavy borrowing into things that you don’t really need.

Got few points that you might get from these Save first then spend later vs Spend first then save later

- You alter your lifestyle accordingly to whatever left after saving with

Save first then spend later. It may sounds like stern action to yourself and come a bit of hardship for temporarily but later things will becomes naturally. Remember old habist die hard right? - If you chose

Spend first then saves laterthis will eventually build your lifestyle according to what you have earn. Pyschologically when your earning gets increased you will spend more and this will brings into heavily spending that might not be favorable if you were tested to bad economy recession like what had happened pandemic due to virus Covid-19.

My advise is:

- Differentiate between needs and wants

- Learn and expose more about financial knowledge and awareness

- Chose or shift your surround friends circle those into financial wisdom

- Knowing how interest rate works or against for you

- Why save and invest early does really matter rather than later

How much do you really need to save?

The best is by putting some percentage from your total monthly or projects income. Eventually you can increase the percentage if you manage to handle or reduce your commitments like debts, school or college expenses to your kids and so on.

Emergency fund or buffer

Having an emergency fund is not just critical for you to face the uncertainty in life but also to avoid from withdrawal of your current investment due to your need to fund current situations. Umprompt investment withdrawal can bring negative effect to your investment worth especially if it happens that current selling price is lower than your previous buying price. This what we call as realised loses

Expert suggests that a person should have buffers between three and six from your monthly incomes. However due to our recent experience due to pandemic I think we should have put aside more than six months for better preparation. What say you my friend?

Protection loss of income

What does it means by loss of income? It means if mishaps happened to you that potentialy give effect such permanent disability or death. What effect that brings to your next-of-kin survival. Are your wife just gave birth to an infants what will be the life to them when you are not around and expect them to face the unexpected life events with no income?

This is the importance of having insurance in terms of managing risk of uncertainty in life. Nobody can predict future. We can never tell what lies ahead. Be prepared is better than being unprepared. It compensate your loss of income by paying a premium according to your age and sum insurance value and usually you stop paying the premium once your claimed has been made.

Compounding interest

Compounding interest is an interesting subject. By knowing what is the interest rate, principal value and multiply the time duration you will be able to know the future value either be an assets or investment.

Formula: Principal value x interest rate x n-times

Let’s make our topic compounding interest to catch your interest.

Assuming you got cash of RM10,000.00. You want to invest in a fund that can gives consistent flat return of 8% every year.

Question: What will be the future value for the next 30 years if you decided not to make any witdrawal during the investment time period?

Let’s illustrate this into a table counted by each year.

Future value of principal value RM10,000.00 Rules of 72

Rules of 72 originated from albert Einstein. It is a formula to proves how long will it takes to double up principal value given a constant % rate of interest. Provided no withdrawal or add sum to principal so whatever during the investment period.

Here is the Rules of 72

Time taken = 72/% rate of interest

Given a flat % rate of interest = 8%

Time taken = 72/8Time take = 9 yearsNow let’s take a look at Future value of principal value RM10,000.00 table.

An initial investment of RM10,000 only.

- started with 8% return that earn RM800 as dividend and add a total investment for the first year RM10,800.

- the following year which is the second year earning increased from RM800 previous year to RM864 an extra of RM64 due to last year compound of investment principal value RM10,800.00

- this compound value add value again and again and take a note at 9th year. It’s compound to a total of RM19,080 which almost double or we just round figure to the next thousand RM20,000.00.

- see the consecutives each 9th years which is 18th and 27th year it yields value of RM19,080 to double RM40,000 on 18th while becomes RM80,000 to year 27th.

- this is what we called as a snowball effect from the investment initial assuming no withdrawal with fixed percent rate of interest.

I guess you can predict what will be the value on 36th, 45th, 56th year and so on. Some says compounding interest is the 8th wonder of the world. I tend to agree but if you don’t, I think that doesn’t really matter.

Now let me throw you a challenge.

Given the same value of initial investment of RM10,000 with no withdrawal not even a single dime and a consistent flat rate of interest 9% per annum. How long will it takes to double up the initial investment using the formula above Rules of 72. Give me your best shot and better if you can share a table like the above example to illustrate the truthfulness of the formula .. 😉

Delay or procastination

Up until now we have seen the Power of Compounding Interest because of its multiplying effect. Now let’s see the effect of procastination!

Procastination/delay effect: Abu VS Baker Above table Procastination/delay effect: Abu VS Baker is a sample of fictional two friends with same age and their different investment approach. It has 3 major columns which splitted to Time next is annually Abu and Baker. Abu started early his investment plan as at 21 years old and Baker prefer to invest later on at age 41 years old.

Here are the details:

- This is an investment duration for 30 years.

- Both Abu and Baker has different approaches. Abu decided to invest early for 20 years with annual investment of RM1,200.00 while Baker got invested 20 years later with amount of RM4,800.00 annually for the next 10 years.

- One thing to note that even though Abu has stopped his annual investment but still he kept the investment keep compounding till the 30th year.

- Total cost of investment for Abu is RM24,000 while Baker double up the total cost compared to Abu by RM48,000.

- By the age both friends at 50 years old the return of investment is vary between Abu and Baker. Abu got his accumulated investment worth RM119,450.00 while Baker investment accumulation is lesser compared to Abu which is RM69,535.50.

Let’s put another table for good illustration between Abu VS Baker

| Item | Abu | Baker |

|---|---|---|

| started to invest (age) | 20 | 40 |

| annual investment | RM1,200 | RM4,800 |

| duration active investment | 20 years | 10 years |

| total cost of investment | RM24,000 | RM48,000 |

| investment cost ratio between them | 1 | 2 |

| total worth of investment (at age 50) | RM119, 450.00 | RM69,535.50 |

| rate return of investment | 500% | 145% |

It’s time for conclusion. Time is our best friend that makes our investment growth in byfold. The early you invest the better will be the worth of investment for longer period. If you go for later investment means the harder you need to put extra cost of investment within short period of time.